It’s all a bit gloomy really, says Forest360 Director Marcus Musson. In his words:

“Daylight savings has finished, lambs and logs are worth bugger all, the media has lost its social license, and the economy is in the cart. No matter who you talk to in the primary and wider sectors, most are facing some significant headwinds in terms of rising costs and reducing sales prices. The days of discussions around the water cooler about what size engine you are putting on your new boat have been replaced by bemoaning about having to sell the boat to recapitalise your business.

“These discussions are probably no surprise as good old uncle Adrian Orr has allowed inflation to run away over the post-COVID era and the countries that we supply our wonderful commodities to (primarily China) have had inflation rates that barely register. This means our costs are higher and our customers don’t have the ability to pay more, which all adds up to margin squeeze and, as primary producers, we are the ones facing the squeeziest of it.

“The state of the China property market is old news now but still incredibly important to our industry. Current Chinese housing starts are back at post GFC 2008 levels which is down 61% from the peak level in 2021. There is a big discrepancy between starts and ‘under construction’ figures which are only down 11% over the same period, something that Goldman Sachs has labelled the ‘completions cliff’. This is explained by the time lag between kicking a project off and completion and does indicate that, once the current builds are finished, the Chinese construction industry will look vastly different. The sentiment of this is playing out in the Iron ore futures markets with a slide that would make Tesla shares look good.

“What has manifested with global log trade is the reduction in non-New Zealand log supply into China with Europe and North America significantly reducing deliveries. New Zealand now has a much larger share of the softwood pie, which is great, but the problem is the pie is now the size of a savoury so to keep things in balance we must keep a lid on the amount of mince and cheese we try to shovel into the savoury.

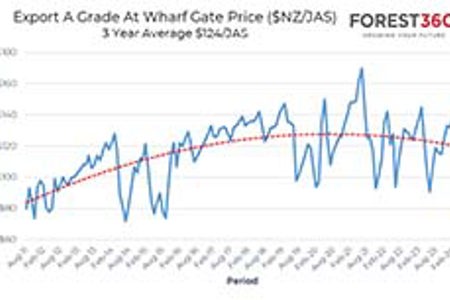

“April export prices are down around $20/m3 from March at approximately $105/m3 and, although not as bad as some have expected, it’s still low enough to see many harvest crews parked up and many of those that are still operating being slowed to minimize the pain. High Chinese port inventory and low demand are the main culprits with increased shipping costs also playing a part. Demand has started to lift post the lunar holiday shutdown and New Zealand supply will start to reduce both seasonally and in reaction to the lower log prices. In addition, the Gabrielle windthrow salvage in Taupo has slowed and will likely stop in the next few months which will take around 15,000m3 of supply out of the system daily. There is the expectation that we have seen the bottom of the cycle and some very faint glimmer of hope that May will see better pricing levels with softer shipping costs and increased demand, although any increase is likely to be marginal.

“Fixed term export prices and other averaging based price structures have enabled many forest owners to keep the gates open and this method of pricing is becoming more popular every time we have a price ‘correction’.

“Domestic sawlog markets continue to tick over and while not breaking any records, they are continuing to hold price and volume. There will likely be some pressure on this market as numbers from Statistics NZ show 2023 dwelling consents were down 26% on 2022 figures. Pruned logs continue to buck the trend in terms of demand and price and have led to a resurgence in demand for pruning which was almost non-existent in the private sector a few years ago.

“Carbon prices fell off the chair following the govt NZU auction in March and following a bit of a rebound have dipped in recent days to $55/NZU. There’s not much of an appetite from larger emitters to engage at present as most have enough to offset their obligations already and won’t need to re-enter the market for some time. As with any market, the NZU price is a victim of supply and demand economics.

“So, in summary, April is bad, not as bad as we thought it would be but that’s cold comfort if you’re a forest owner or out-of-work contractor. The market will bounce, as it always does, but this time it may be reminiscent of a half flat Swiss ball, it’ll still bounce but not as high as we would like and will depend on supply levels from New Zealand. On a positive note, at least we don’t deal in Iron ore… ”